Ali Express Collecting Sales Tax

Aliexpress and ebay are now collecting sales tax. Aliexpress and ebay are now collecting sales tax Reply 19 on.

I am a reseller purchasing items strictly for resale and am NOT happy at the moment.

Ali express collecting sales tax. The sellers are unaware that AliExpress is assessing sales tax all of a sudden. Data-appnsSERP data-k59401Save Settings. E-commerce retailers either charge the buyers local tax rate or establish a NEXUS rate which means that the retailer has registered as conducting business from a particular state or county because they.

Food ingredients however prepared foods are taxed clothing and footwear 175 or less. I called several places that would know in my statethe answer was that Aliexpress IS lying. There are many things that are not taxed in my home state at the retail level.

AliExpress is an arm of the bigger Alibaba company. October 08 2019 014655 am. They can be from different stores.

If AliExpress is collecting sales tax they must be using an American state for shipping orders. However the VAT rate is dependent on the package content for AliExpress baby clothing has a VAT rate of 0 for example. A little over half the US.

Void0 hIDSERP59381More optionsManage Cookie PreferencesWe also use essential cookies these cannot be turned offAnalyticsWe may allow third parties to use analytics cookies to understand how you use our websites so we can make them better and the third parties can develop and improve their products which they may use on websites that are not owned or operated by MicrosoftOffSocial MediaWe may use social media cookies to show you content based on your social media profiles and activity on our websites. Have a physical location in the state. Reply 36 on.

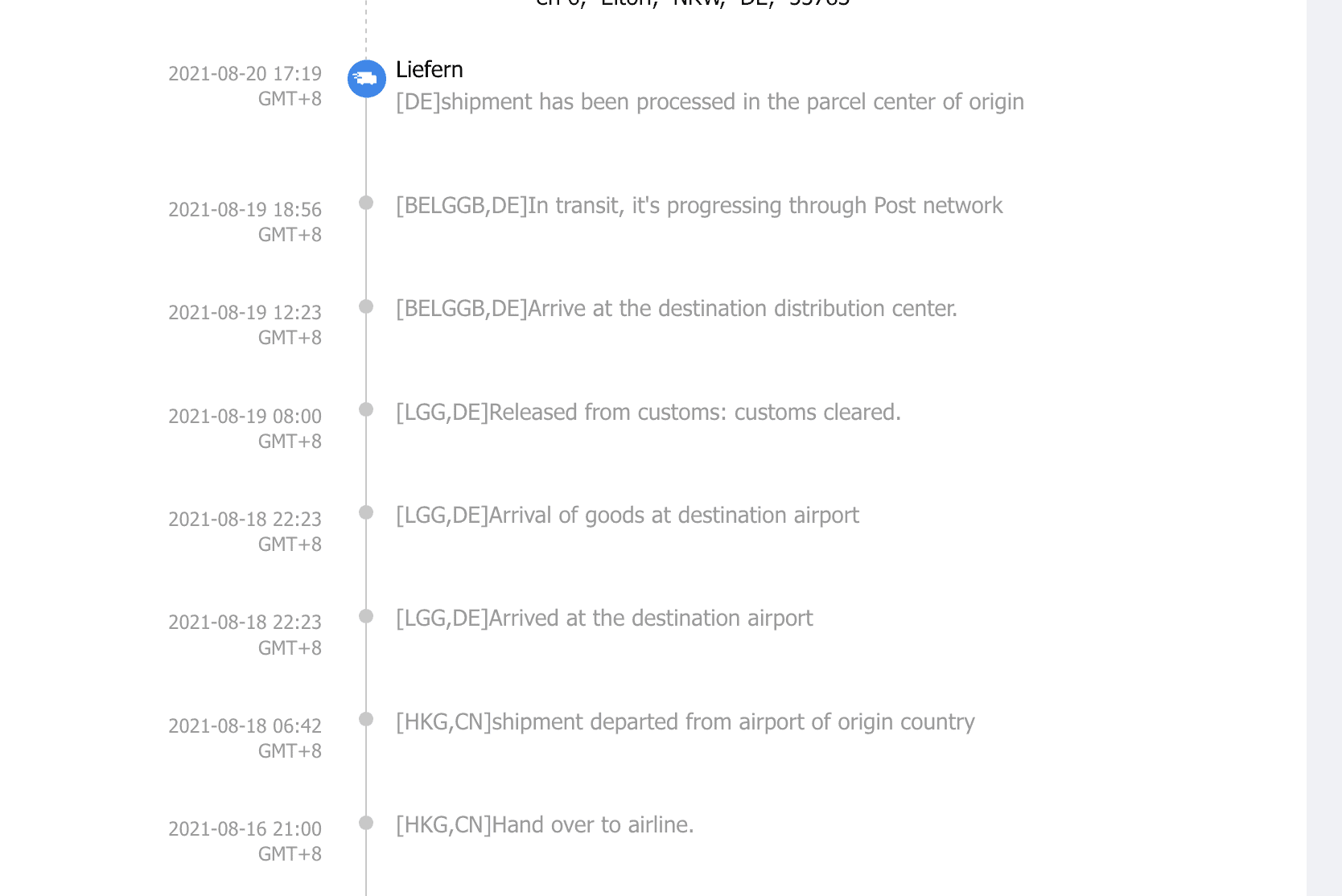

Dont exceed your country customs duty-free limit Dont exceed your country customs duty-free limit The extension shows information about orders for each address calculated by the formula. AliExpress Import Tax in Australia. I made a purchase from aliexpress about a month ago and I just picked up one of my parcels from the post office.

Goods imported from AliExpress are now subject to sales taxes. You are required to pay this 84 cents to the State of Arizona when tax time comes around. I have sent message to sellers and they responded that they did not charge or receive the tax amount that I have been charged.

They can be from different stores. On my recent purchases I was charged the sales tax. So that means it.

Theyre used to connect your activity on our websites to your social media profiles so the content you see on our websites and on social media will better reflect your interestsOffAdvertisingEnable the use of cookies for making advertising more relevant and to support the sourcing of high-quality content on this site If you dont allow this use then ads shown to you may be less relevantOff. Always have a valid sales tax permit before you begin collecting. Answer 1 of 15.

The sales tax rate is 56 So in this case here the text to collect is 84 cents. In June 2018 the Supreme Court made it so all online sales had to collect sales tax beginning 2019. I was already paying sales tax on items purchased on eBay in Colorado so I am wondering why Aliexpress is just now collecting sales tax.

This applies to orders valued at AUD1000 or under for product categories such as books jeweler electronic devices sports equipment cosmetics and clothing. There are resident employees working. States with a sales tax allow online sellers to keep a small percentage of the sales tax youve collected as bit of a monetary thank you for your effort collecting and remitting the tax.

40px. To keep up to date with local authority laws check out our AliExpress sales taxes guide. K Kiki wong Oct 19 2019.

Imported goods in Australia are charged a 10 GST on the price of products. A good rule of thumb is an added 20 of the total value of the package as additional AliExpress import VAT rate. You are required to pay this 84 cents to the State of Arizona when tax time comes around.

In their point of view if you collect without a permit you are representing to your customers that youre collecting sales tax but pocketing the money for yourself. Total amount Sum of delivering orders The amount of received orders for current month385. Also this is the first notification I have received regarding this New Internet Sales Tax and I sell on the big 3 online sales platforms.

If you agree we will use this data for ads personalization and associated analyticsYou can select Accept to consent to these uses or click on More options to review your options You can change your selection under Manage Cookie Preferences at the bottom of this page. No taxes or duties to be paid According to the tracking history this assessment was. When they issue your sales tax permit your state will also assign you a sales tax filing frequency.

This is generally either monthly quarterly or annually. Something rotten in the State of Denmark. I just got an email from eBay explaining that 11 new states have adopted Internet Sales Tax Policy as of today October 1st.

There are two ways that e-commerce retailers collect taxes from online orders. Having a nexus means that a seller has a presence in that state - a home or an office a warehouse employees or significant sales. October 06 2019 063640 pm Its not about taxing eBay and AliExpress but about taxing users of eBay and AliExpress and specifically forcing the platforms to collect the tax as they are large entities easier to pressure and intimidate than millions of individuals who dont give a fuck.

Aliexpress is charging their customers for US taxes this IS illegal contact the Federal Trade Comissionso far they are the Only site doing this and the FTC needs people to open cases against themAliexpress will tell you that they are commissioned by our states to collect the taxit is not true. Of course then you will have the responsibility of collecting and remitting DC sales tax on all sales shipped into DC. Void0 hIDSERP59371Accept.

I didnt read anything about sales from foreign countries being included in. For example District of Columbia requires the out-of-state seller to register for a DC sales tax permit in order to issue a resale cert to the drop shipper AliExpress in order for AliExpress to not charge you the sales tax. The tracking reports from both Aliexpress and Philpost said Import authorised.

Aliexpress Und Die Umsatzsteuer Wie Lauft Das Aktuell Keine Angst Vor Bestellungen Aus China Techtest

Aliexpress Und Die Umsatzsteuer Wie Lauft Das Aktuell Keine Angst Vor Bestellungen Aus China Techtest

Aliexpress Und Die Umsatzsteuer Wie Lauft Das Aktuell Keine Angst Vor Bestellungen Aus China Techtest

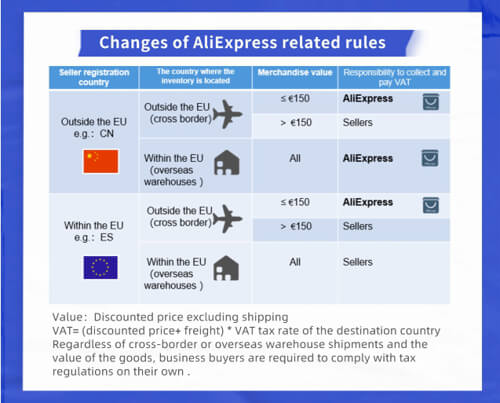

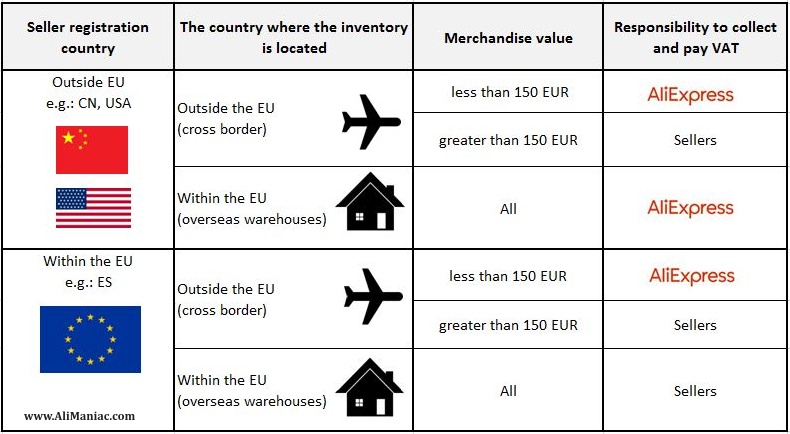

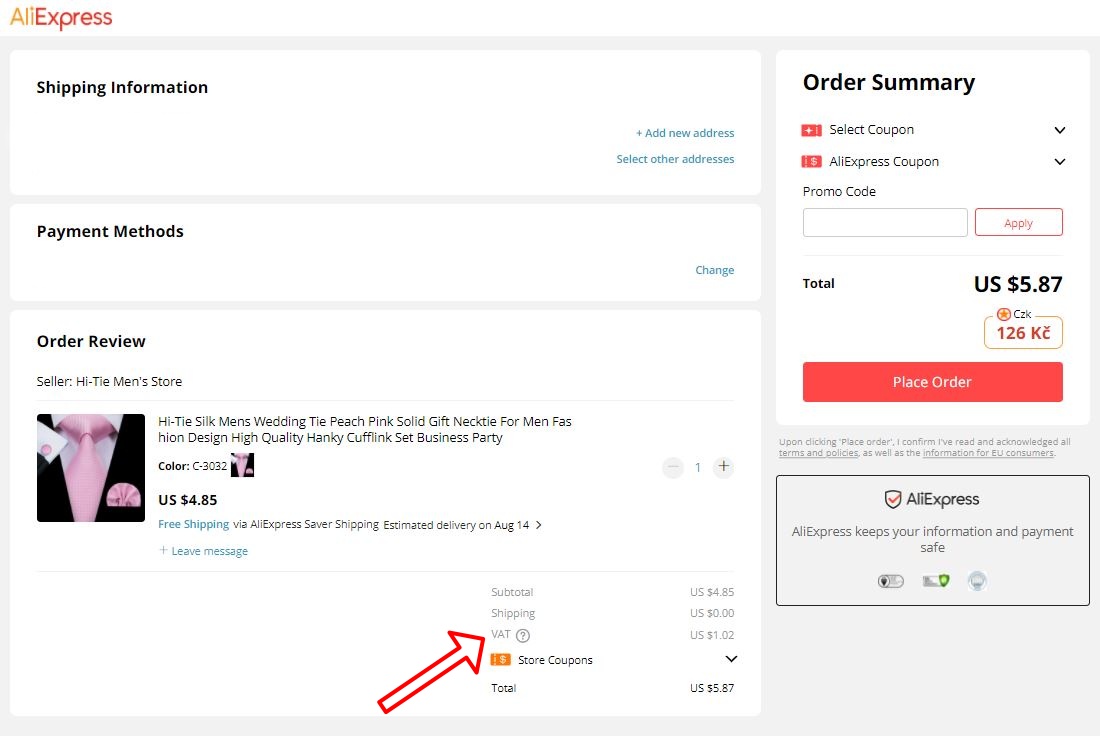

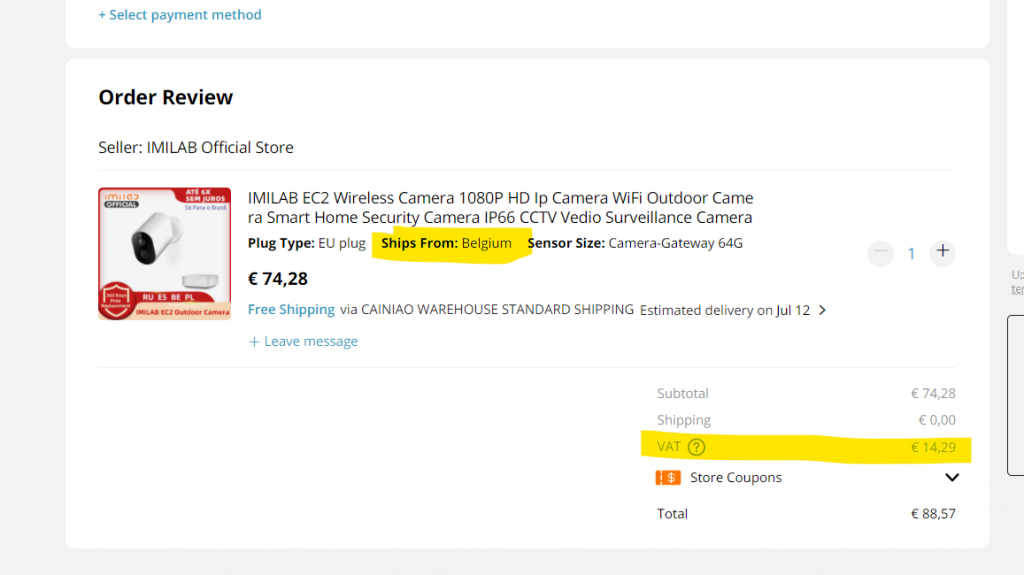

At Aliexpress We Will Pay Vat Directly Information About The New Rules

How To Get An Invoice From Aliexpress Megabonus

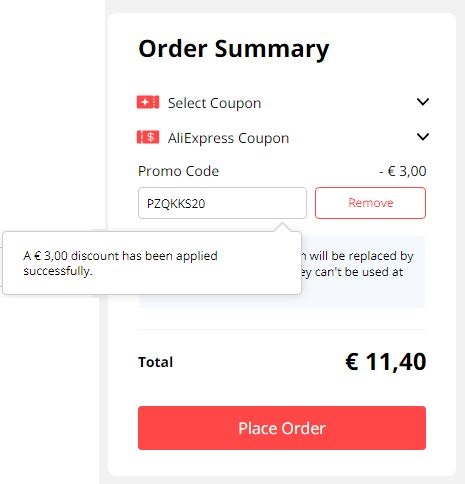

Aliexpress Will Automatically Collect Vat From 1 7 Thanks To Ioss Registration

Dropshipping Orders Cancelled And Credit Card Blocked By Aliexpress Dropshipping Products Credit Card Dropshipping

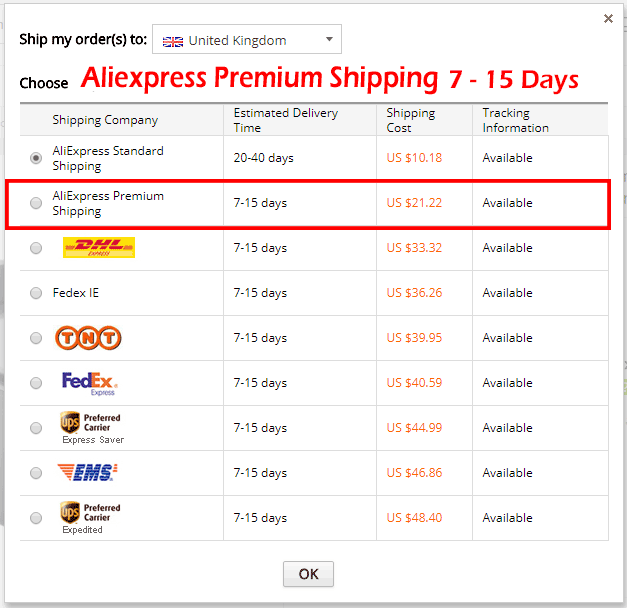

Aliexpress Combined Delivery What Is It And How Does It Work

Aliexpress Germany Essential Buyers Guide 2021

At Aliexpress We Will Pay Vat Directly Information About The New Rules

At Aliexpress We Will Pay Vat Directly Information About The New Rules

Aliexpress Und Die Umsatzsteuer Wie Lauft Das Aktuell Keine Angst Vor Bestellungen Aus China Techtest

Aliexpress Will Automatically Collect Vat From 1 7 Thanks To Ioss Registration

At Aliexpress We Will Pay Vat Directly Information About The New Rules

At Aliexpress We Will Pay Vat Directly Information About The New Rules

Posting Komentar untuk "Ali Express Collecting Sales Tax"