Does Ali Express Collect Sales Tax

The sales and use tax exemption applies only to construction and building materials that become part of structures highways roads streets. But if your business creates logos for coffee shops you shouldnt charge sales tax for those services.

Something rotten in the State of Denmark.

Does ali express collect sales tax. There are two things to keep in mind for AliExpress import duty for the UK. Starting first with the easiest. The contractor does not collect any sales tax from the homeowner.

All states have specific requirements for applying sales tax which must be followed. When it comes to sales tax the general rule of thumb has always been products are taxable while services are non-taxable Under that scenario if your business sells coffee mugs you should charge sales tax for those products. Similar to AliExpress tax in the USA Canada doesnt tax packages valued below a certain amount.

Wherever you have sales tax nexus you are responsible for collecting local as well as state sales taxes. You must show the tax amount separately so the customer can see the amount of the tax. That means if a customer who also lives in Arizona comes to your Dropshipping store and purchases a mug from you you would be required to collect and pay sales tax on that order.

In June 2018 the Supreme Court made it so all online sales had to collect sales tax beginning 2019. The tracking reports from both Aliexpress and Philpost said Import authorised. Gold bullion below 0995 purity Silver bullion below 0999 purity Platinum bullion below 09995 purity Palladium bullion below 09995 purity.

Here are a few. While Amazon will collect and remit sales tax on your behalf you are still required to collect sales tax from both your brick and mortar and your Shopify customers in states. No taxes or duties to be paid According to the tracking history this assessment was.

Common Exceptions to Sales Tax on Shipping. How to shopify dropshippers pay income tax income tax. How to Specify Sales Tax.

The first is income tax and the second is potentially sales tax. Aliexpress and ebay are now collecting sales tax Reply 19 on. Collect Sales Taxes from Customers.

The laws change by state but in most states if your yearly sales in that state are higher than 100000 or 200 transactions you have a nexus even if you dont have any. Include local sales taxes. For example District of Columbia requires the out-of-state seller to register for a DC sales tax permit in order to issue a resale cert to the drop shipper AliExpress in order for AliExpress to not charge you the sales tax.

I didnt read anything about sales from foreign countries being included in. For higher valued goods the Government of Canada will collect the Goods and Services Tax GST a rate of 13. How you collect sales tax for Maryland depends on whether youre in- or out-of-state.

Provinces that collect both the GST and the Provincial Sales Tax PST are. This typically isnt a problem since most sales receipts are programmed to show the amounts. What taxes do I need to pay when aliexpress dropshipping.

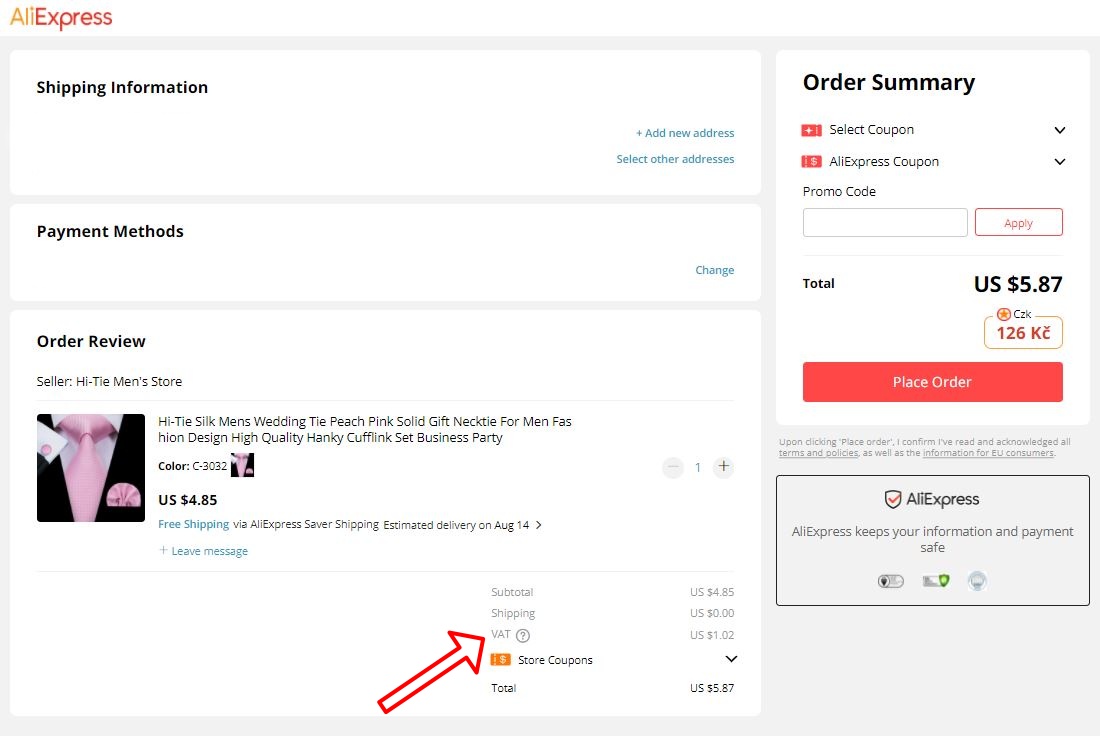

Regardless of if youre in- or out-of-state you must collect 6 sales tax from Maryland customers. To keep up to date with local authority laws check out our AliExpress sales taxes guide. The sellers are unaware that AliExpress is assessing sales tax all of a sudden.

After you have received your sales tax permit you can begin collecting sales tax from customers. Sales tax is only applied if the buyer is shipping to a state that requires sales tax remittance. SD Bullion is required to collect Ohio sales tax on the following items.

Having a nexus means that a seller has a presence in that state - a home or an office a warehouse employees or significant sales. Of course then you will have the responsibility of collecting and remitting DC sales tax on all sales shipped into DC. AliExpress Import Tax for the UK.

The sales tax rate in Arizona is 56 so this is how much sales tax you would need to collect and pay to the Arizona state. I recommend reading each states sales tax law or FAQ on shipping because many states have exceptions to their normal rules. A seller is able to specify states where sales tax is applied during the listing process.

AliExpress is an arm of the bigger Alibaba company. Goods imported from AliExpress are now subject to sales taxes. I am a reseller purchasing items strictly for resale and am NOT happy at the moment.

There are two main types of taxes that you need to pay. FUCK yup there is now sales tax for usa. If your business is in Maryland collect sales tax based on where your customer lives.

Aliexpress is charging their customers for US taxes this IS illegal contact the Federal Trade Comissionso far they are the Only site doing this and the FTC needs people to open cases against themAliexpress will tell you that they are commissioned by our states to collect the taxit is not true. Only its significantly lower CAN20. That makes me seriously consider not using AliExpress anymore un less the product is much cheaper.

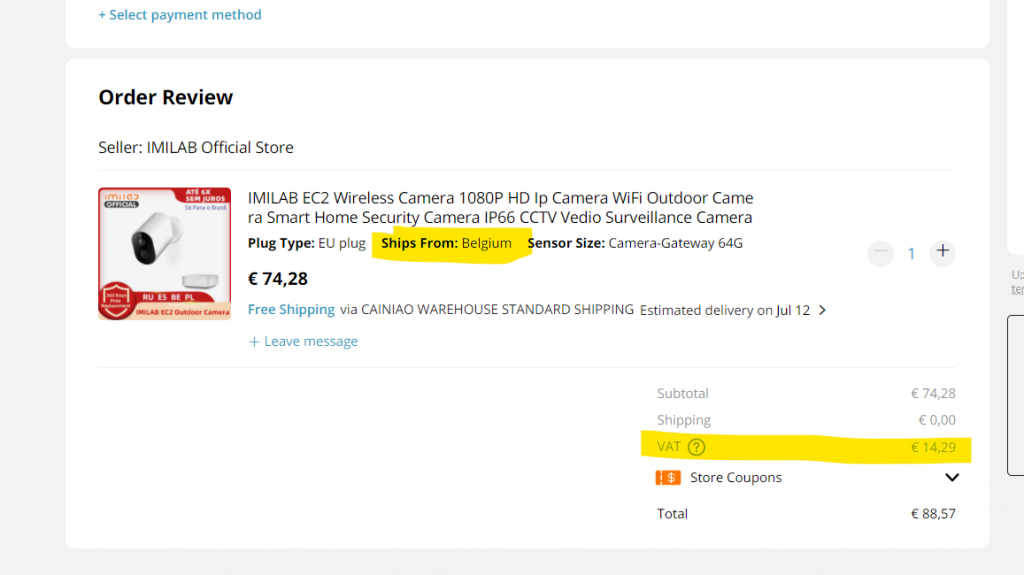

One if the value of the package is above 15 you will have to pay VAT. In this case he would collect a total of just 11600 from the customer because he was not required to collect sales tax on the 10 shipping charge. Sellers who make a sale in Maryland but work outside of the state must charge sales tax based on the destination of the buyer.

October 06 2019 063640 pm Its not about taxing eBay and AliExpress but about taxing users of eBay and AliExpress and specifically forcing the platforms to collect the tax as they are large entities easier to pressure and intimidate than millions of individuals who dont give a fuck. However the VAT rate is dependent on the package content for AliExpress baby clothing has a VAT rate of 0 for example. You sell via Amazon FBA at your brick and mortar store and through your brands Shopify store.

Online sellers are obligated to collect sales tax in states where they have a nexus. Tax-exempt construction projects Construction and building materials a contractor purchases for use in construction projects for tax-exempt entities are exempt from state sales and use tax. If AliExpress is collecting sales tax they must be using an American state for shipping orders.

Well there go any seller discounts tax will eat those right up for the most part. A good rule of thumb is an added 20 of. If the seller does not collect.

No taxes or duties to be paid.

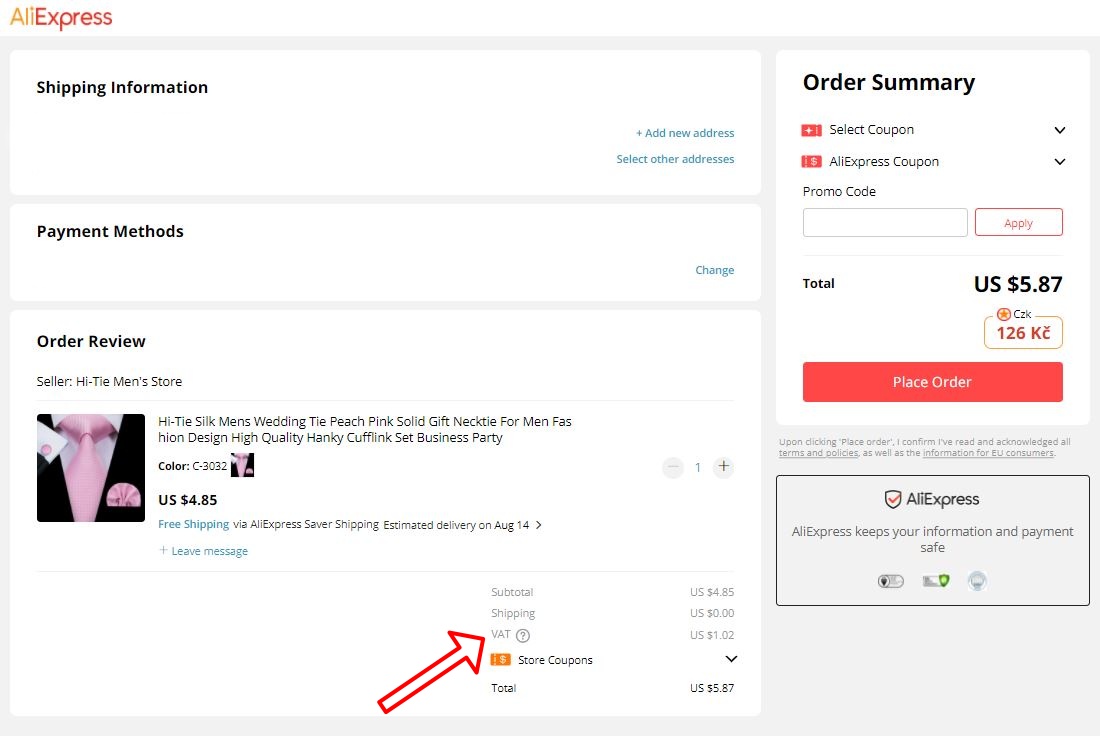

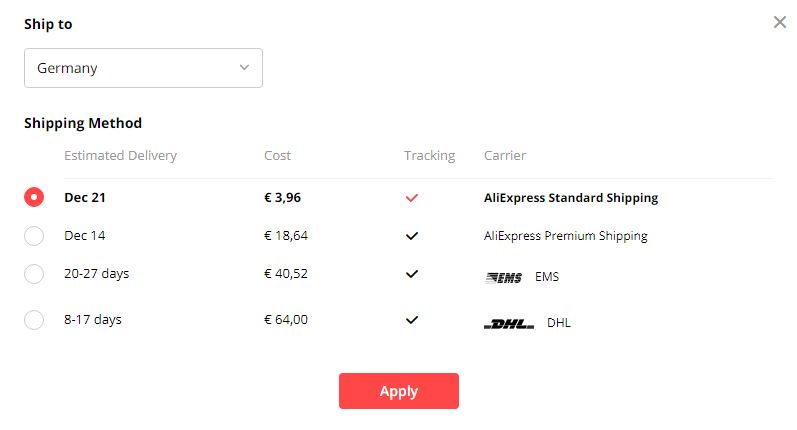

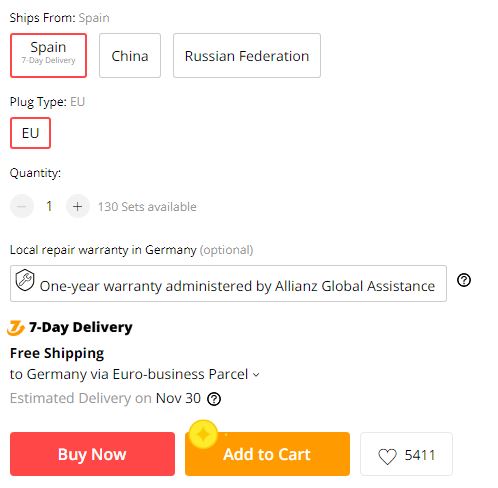

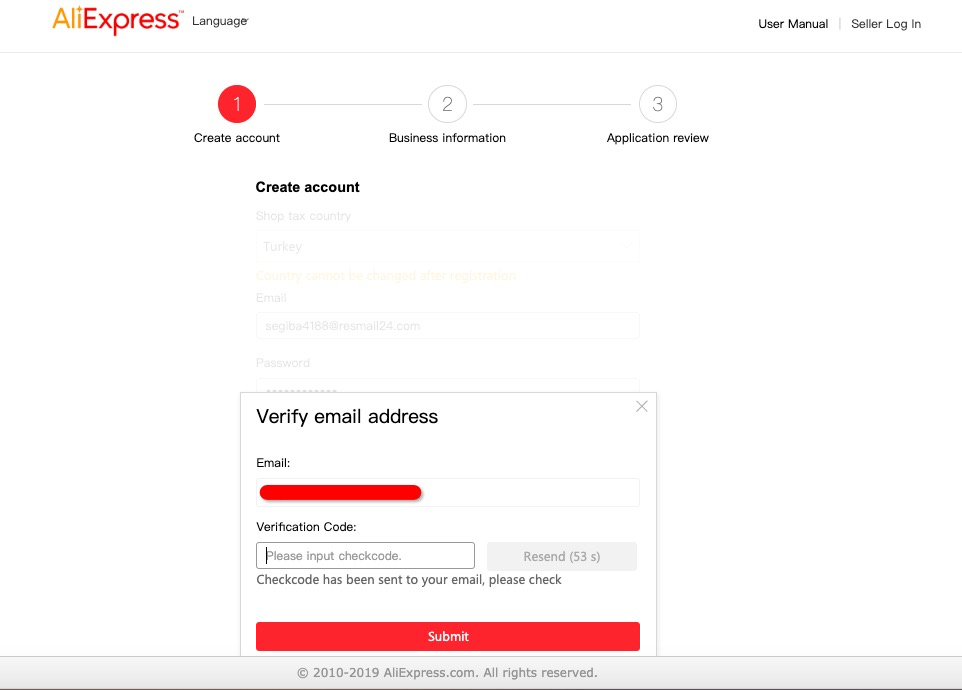

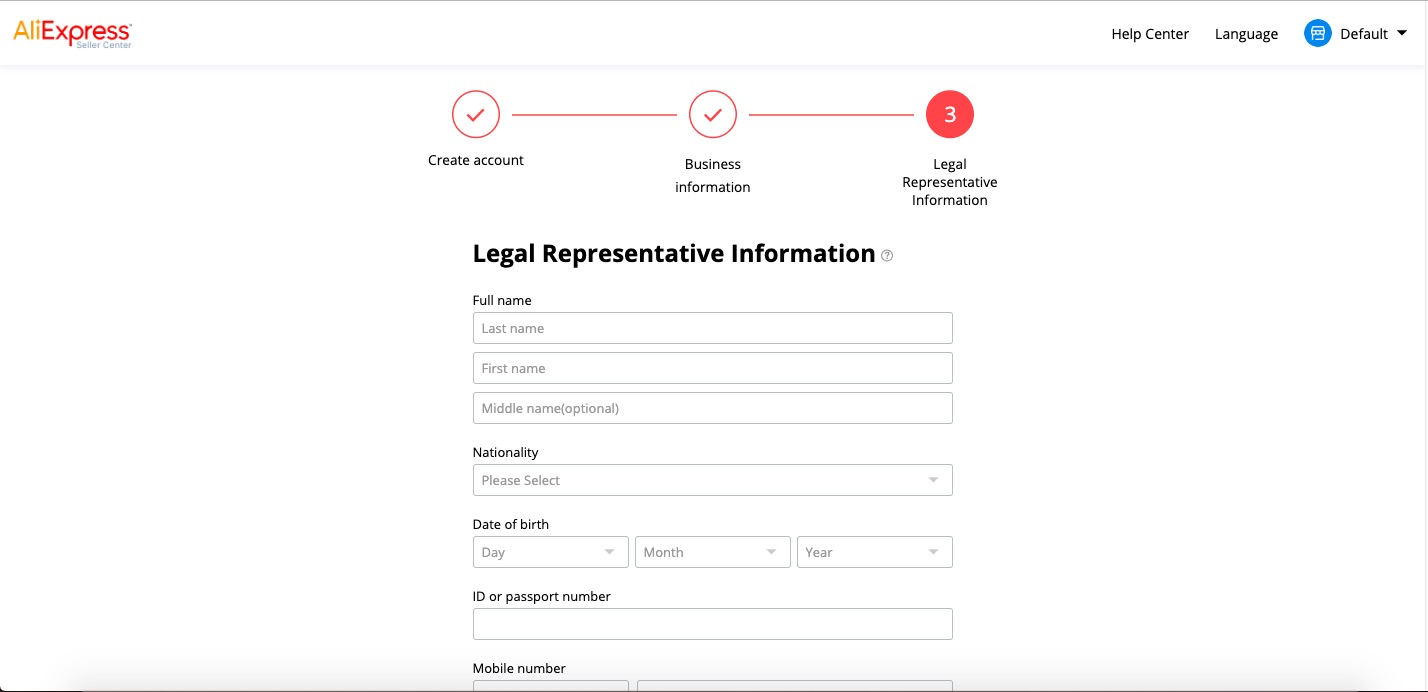

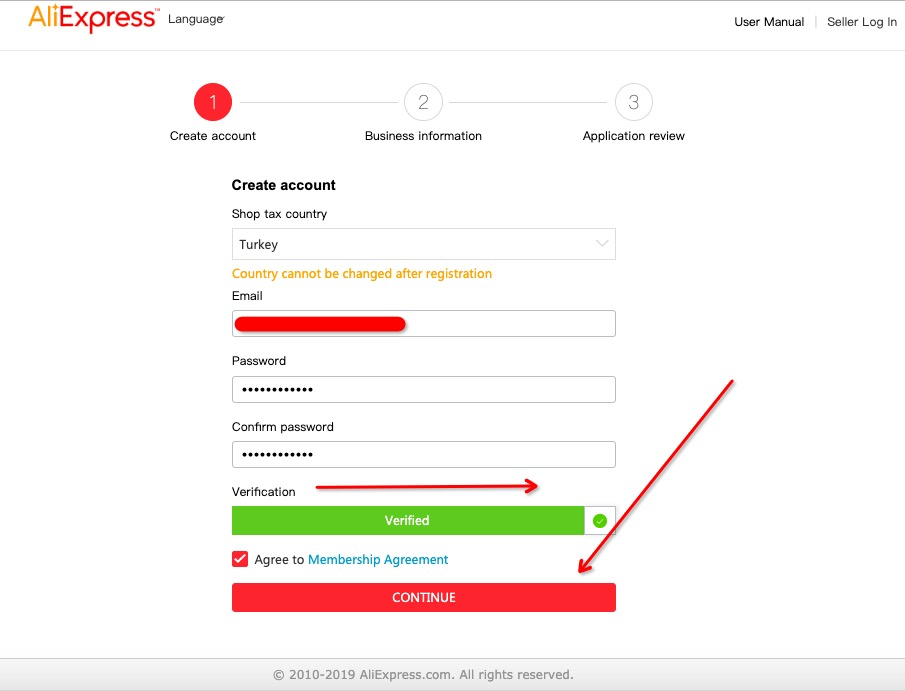

Aliexpress Germany Essential Buyers Guide 2021

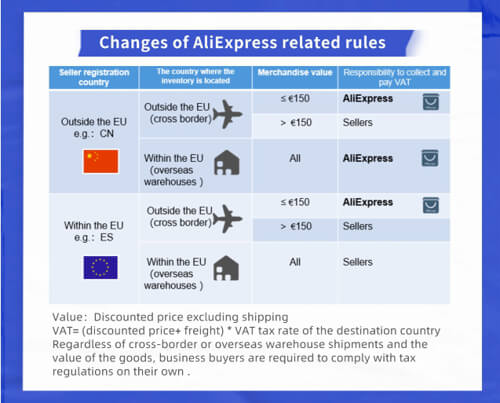

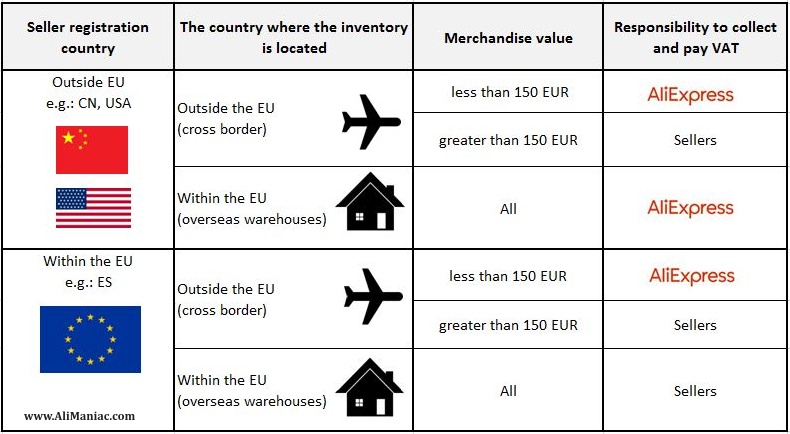

At Aliexpress We Will Pay Vat Directly Information About The New Rules

At Aliexpress We Will Pay Vat Directly Information About The New Rules

At Aliexpress We Will Pay Vat Directly Information About The New Rules

Sheet Now Norwegians Has To Pay Tax Or Is This For Everyone At Least It Ll Be Less Purchases Through Norway R Aliexpress

At Aliexpress We Will Pay Vat Directly Information About The New Rules

How To Shop On Aliexpress The Definitive Guide 2021

How To Buy On Aliexpress Portugal Definitve Guide 2021

Aliexpress Will Automatically Collect Vat From 1 7 Thanks To Ioss Registration

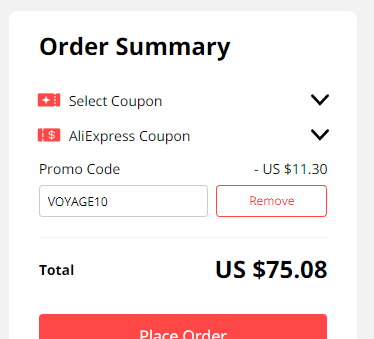

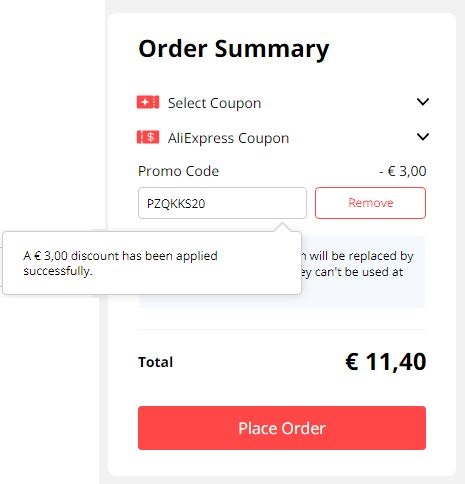

How To Get A Discount On Aliexpress Megabonus

Aliexpress Germany Essential Buyers Guide 2021

Aliexpress Will Automatically Collect Vat From 1 7 Thanks To Ioss Registration

/aliexpressquestions-5b88ec3ec9e77c005010192e.jpg)

What Is Aliexpress And Is It Legit

Aliexpress Germany Essential Buyers Guide 2021

At Aliexpress We Will Pay Vat Directly Information About The New Rules

What Does Aliexpress Take From Its Sellers Quora

Posting Komentar untuk "Does Ali Express Collect Sales Tax"